Pre qualify for fha loan with bad credit

Citizen or legal resident. First Time Home Buyer Loan.

2022 Fha Qualifying Guidelines Fha Mortgage Source

Compare rates from pre-qualified and approved mortgage lenders 100 online 100 free.

. No income limit Conventional 97 Loan. Compare online mortgage lenders local banks and credit unions to find the best bad credit mortgage loan options. Lenders such as Upstart OneMain financial and Lending Point can help borrowers with bad credit.

Second mortgage types Lump sum. Best Mortgage Lenders for FHA Loans. Combine the flexibility of a card with the low cost and predictability of a loan.

0 Annual Fee. Other Requirements FHA Loan. On Wednesday September 7th 2022 the average APR on a 30-year fixed-rate mortgage fell 7 basis points to 5942The average APR on a 15-year fixed-rate mortgage fell 10 basis points to 5101.

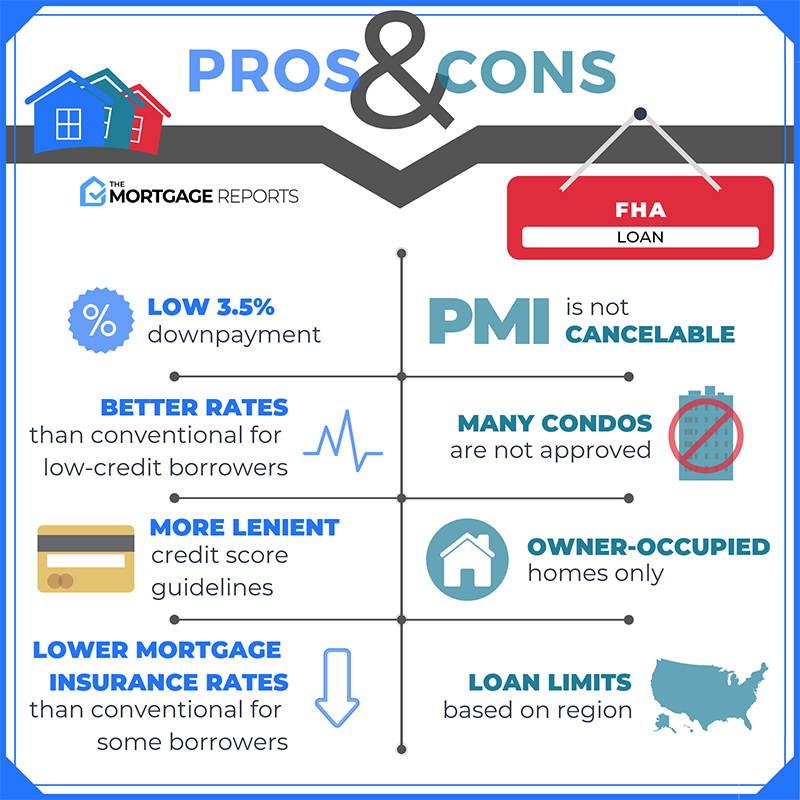

A minimum of 500 preferably 580. Citizen at least 18 years old and have a regular income a checking account and a valid email address. An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration FHA.

Searching for a bad credit personal loan shouldnt be scary but sometimes it can be. You can only get a new FHA loan if the home you consider will be your primary residence which means that it cant be an investment property or second home. Earn a credit limit increase in as little as 6 months.

Specializes in bad credit no credit bankruptcy and repossession. Terms and conditions apply. There are certain requirements borrowers must meet to qualify for an FHA loan including.

Benefits of FHA Loans. Network of dealer partners has closed 1 billion in bad credit auto loans. Click here for application terms and details.

In business since 1999. 0 fees - 0 annual fee 0 activation fees 0 maintenance fees. The home you consider must be appraised by an FHA-approved appraiser.

To prequalify for a loan arranged by Bad Credit Loans you must be a US. Bad credit applicants must have 1500month income to qualify. What will help however is having a sizable down payment preferably 20.

Displayed information is valid as of Sep 07 2022 and assumes a customer with a 740 credit score borrowing a conventional loan for a single-family primary residence at or near zero discount points and a 80 loan-to-home-value ratio. Upstart has a minimum credit score requirement of 580. 300 5000 credit limits.

What Are Compensating Factors for FHA Loan Approval. FHA loans are designed to be more forgiving of past credit issues. You must occupy the property within.

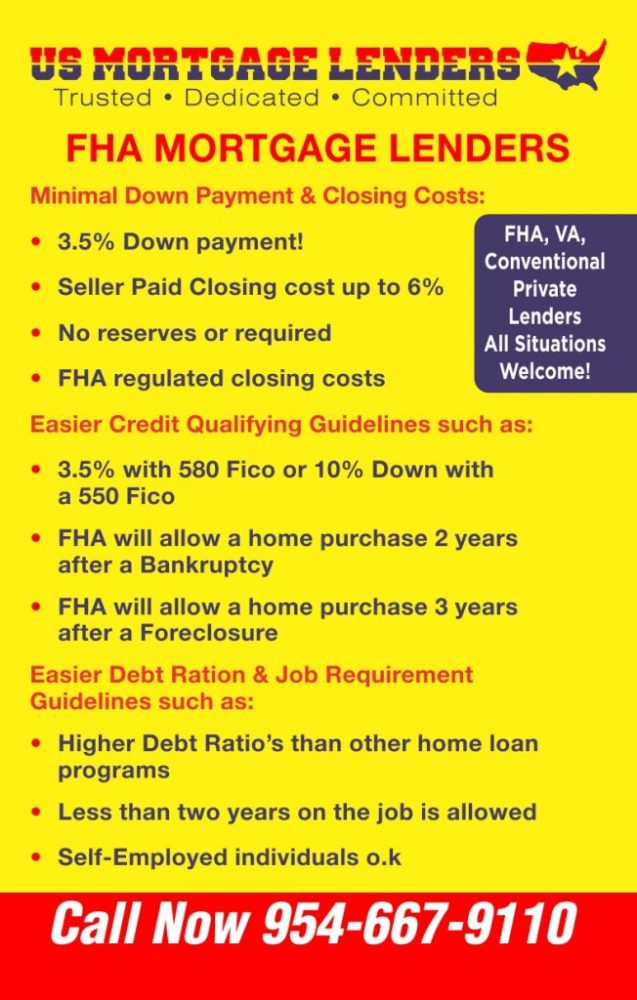

For FHA loans down payment of 35 percent is required for maximum financing. Thats because the never-ending terms and conditions associated with financial products can make them difficult to understand. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

A down payment of at least 10 is needed to qualify for an FHA loan if your credit score is below 580 compared to 35 if your score is 580 or better. FHA LOAN TERMS FOR MOBILE HOMES The terms of an FHA loan for mobile homes include a fixed interest rate for the entire 20-year term of the loan in most cases. September 1 2022 - Borrowers who have high debt ratios andor FICO score issues may still be able to be approved for an FHA mortgage loan but the lender may require one or more compensating factors to justify loan approval.

Easy 30-second pre-qualification form. Receiving pre-approval is a. Typically an FHA loan is one of the easiest types of mortgage loans to qualify for because it requires a low down payment and you can have less-than-perfect credit.

Consider FHA VA or USDA loans as well as conventional loans and get quotes. Second mortgages come in two main forms home equity loans and home equity lines of credit. To qualify for the loan your front-end and back-end DTI ratios must be within the 2836 DTI limit calculator factors in homeownership costs together with your other debts.

A hard credit inquiry which temporarily lowers your credit. Best for low or bad credit. Borrowers can obtain a loan from a direct lender on the Bad Credit Loans network ranging from 500 to 5000 with a repayment period of three to 60 months.

Neither pre-qualification nor preapproval guarantees loan approval and the loan rate and terms can change later in the loan process. Bad Credit No Credit - OK. Meanwhile pre-approval is a formal assessment of your credit background.

Loans are available in amounts from 500 to 10000 with payment terms from three to 72 months. That term can be extended up to 25 years for a loan for a multi-section mobile. Up to 1000 credit limit subject to credit approval.

Loan is 35 if your credit. Easy 30-second pre-qualification form. An FHA 203k loan helps you buy a fixer-upper or renovate your current home.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Some of Acorn Finances lending partners have been called the best lenders for bad credit. Variable APRs range from 2224 3174.

You may qualify for an FHA home loan with a credit score in the 500 to 579 range but youll have to put 10 down. Low Down Payments and Less Strict Credit Score Requirements. Pre-qualify without affecting your credit score.

Get pre-approved before you apply. Best for first-time home buyers. FHA loans are designed for low-to.

Seem daunting to qualify for a car loan with. The biggest risk youll face when you take a bad credit. New American Funding.

If your score is 580 or higher the FHA down payment requirement is 35. Best for low or bad credit scores overall. Government workers should have no problems meeting the requirements for loan approval which include being a US.

Heres how you can pre-qualify for Chase credit cards including Chase Sapphire and Chase Freedom Unlimited. Like other FHA loan products the mobile home must be considered the primary residence of the FHA borrower. Getting a car loan with bad credit is still possible though you need to be careful of high rates and fees.

Best for FHA loans. Youll need a credit score of at least 500 to qualify for an FHA 203k loan. Bad credit applicants must have 1500month income to qualify.

Most people shy away from researching bad credit loans because they think they wont qualify on account of their bad credit score. What lenders can potentially prequalify a personal loan for bad credit.

Pin By Online Shopping Addict On Amandasells Com Fha Loans Mortgage Loans Fha

Fha Loan With A 620 Credit Score Fha Lenders

Prequalify For An Fha Loan

Fha Loans Everything You Need To Know

Minimum Credit Scores For Fha Loans

Fha Loan What To Know Nerdwallet

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

Fha Mortgage Rates Best Fha Home Loan Rates Programs

Fha Loans Complete Guide For First Time Homebuyers Credible

Fha Mortgage Loan Process Checklist Refiguide Org Home Loans Mortgage Lenders Near Me

Fha Interest Rates Online 52 Off Www Ingeniovirtual Com

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Why You Don T Need An 800 Credit Score For A Kentucky Mortgage Loan Approval

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Kentucky Fha Mortgage Guidelines

3 5 Down Florida Fha Mortgage Lenders Min 580 Fico

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference